Premier Energy

Advisory Services

WHO WE ARE

Eagle River is an industry-leading oil and gas transactional advisory firm focused exclusively on the North American oil and gas sector. We specialize in middle-market engagements ranging from $5MM – $300MM in value. Our mission is to maximize value for our clients and achieve their goals in every transaction.

LATEST OPPORTUNITIES

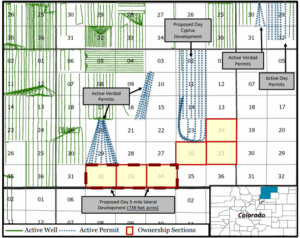

DJ Basin Leasehold – Weld, CO

Asset Summary

Twn

Rng / Sec. / Net Acres

1N

64W / 24 / 304

1N

64W / 25 / 56

1N

64W / 26 / 40

1N

64W / 32 / 127

1N

1N

Total

64W / 33 / 40

64W / 34 / 572

1,139

Active

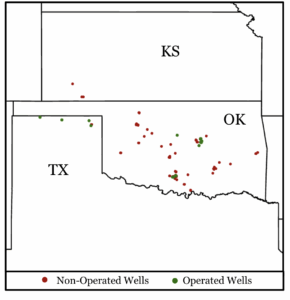

Mid-Con Operated and Non-Operated WI Assets

Asset Summary

Total Wells

103 PDP

PDP Wells

27 Operated / 76 Non-Op

Net Production (4/2025)

69 BOE/D (47% Oil)

PDP PV-9 ($MM)

$4.8 MM

PDP Reserves (2 Stream)

490 MBOE (76% Oil)

2024 Net Cash Flow

$900K 2

Active

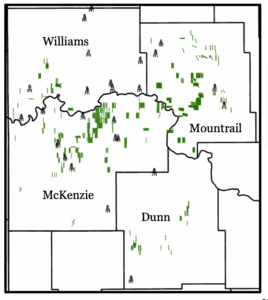

Non-Op Wellbore Only WI and ORRI Opportunity in the Williston Basin

Asset Summary

Gross Wells

940 PDP / 26 PDNP

Average WI % / NRI %

1.6% WI / 1.3% NRI (82.0% 8/8 NRI)

Wells with ORRI

77% of wells

TTM – 4/25 Net Operating Income

$3.7 MM

4/25 Net Production

531 boe/d

Active