Sell Side Engagements

Status

Year

White Rock Oil & Gas Williston Basin Leasehold Assets

Asset Summary

Total Net Acres

7,585 Net Acres

Total Net Bakken Acres

5,933 Net Acres

Middle Bakken PUDs

~76

2-Mile Middle Bakken Type Curve EUR

611 MBOE (79% Oil)

3-Mile Middle Bakken Type Curve EUR

904 MBOE (79% Oil)

Drilling Econ (2-Mile)

47% IRR /2.4x ROI

Active

Joint Venture Drilling Opportunity in the North Park Basin of Colorado

Asset Summary

Total Investment Opportunity

~$22 MM

Total Wells

8 PUDs

Target Formation

Niobrara

Project Economics – IRR/ROI

46% / 2.7x

Active

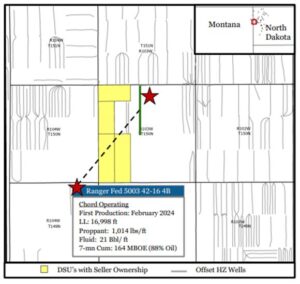

Operable HBP Leasehold and Production for sale in McKenzie County, ND

Asset Summary

HBP Acres

1,865 Net Acres

Average NRI

80.9%

Production

16 BOPD

1280 DSUs

2

Bakken PUDs

7

Bakken Type Curve

645MBOE – Drilling ECON~46% IRR ~ 2.8x ROI

Active

Leasehold Assets in Williston Basin – Basin Oil & Gas and Cobra Oil & Gas

Asset Summary

Total Net Acres

~9,300 Net Acres

DSUs

> 50 DSUs

Middle Bakken PUDs

> 100 Horizontal Middle Bakken PUD Locations

Middle Bakken Type Curve EUR

810 MBOE (2-Mile) / 1,110 MBOE (3-Mile)

Drilling Econ *

2-Mile:188% IRR / 3.3X ROI and 3-Mile: 200% IRR / 3.6X ROI

*Economic assumptions: $75 WTI and $2 Henry Hub, 80% NRI, -$5 Oil Diff, -$1 Gas Diff and D&C of $7.5MM for 2-mile and $9.0MM for 3-mile

Closed

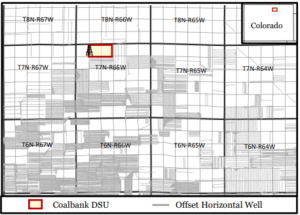

Non-Operated Working Interest Opportunity in the DJ Basin

Asset Summary

Wells

3

Average WI% / NRI%

15.27% / 12.23%

Formation

Codell

Total Net AFE Capital

$2.4 MM

White Rock Oil & Gas Williston Basin Leasehold Assets

Asset Summary

Total Net Acres

3,046 Net Acres

DSUs

4 DSUs

Middle Bakken PUDs

>16 Horizontal Middle Bakken PUD Locations

Middle Bakken Type Curve EUR

1,093 MBOE (2-Mile) / 1,519 MBOE (3-Mile)

Drilling Econ 2-Mile : 3-Mile

69% IRR / 4.3X ROI : 97% IRR / 5.2X ROI

* Assumes $70 WTI, $2.50 HH, D&C for 2-Mile: $8.5MM and 3-Mile: $10.5 MM

Closed

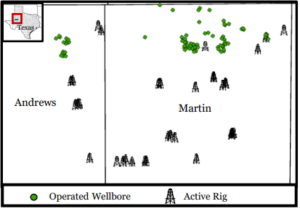

Operated Conventional Assets in the Midland Basin

Asset Summary

Total Wells

79

Net Production

121 BOE/D (99% Oil)

Average WI% / NRI%

93.8% WI / 71.8% NRI

NTM Cash Flow

~$0.8 MM

PDP Reserves

~303 MBOE (96% Oil)

PDP PV-10

~$3.3 MM

Closed

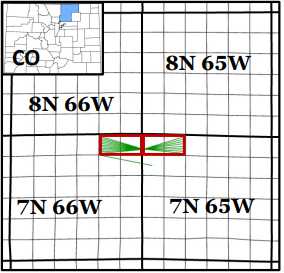

Non-Operated Working Interest Opportunity in the DJ Basin

Asset Summary

PDP Wells

20

Average WI % / NRI %

4.8% / 3.8%

Net Production (7/2024)

92 BOE/D

NTM Cash Flow

$923 M

PDP PV-10

$2.8 MM