Asset acquisition and divestiture (A&D) activity in 2025 reflects a more disciplined, targeted approach among upstream companies across the U.S. Mid-sized operators, non-op holders, and mineral owners active in the Permian, Williston, and Powder River Basins are adjusting strategies in response to shifting capital flows, development priorities, and pricing pressures. This year, success depends on understanding regional trends and aligning with the right market windows.

Strategic Consolidation in the Permian Basin

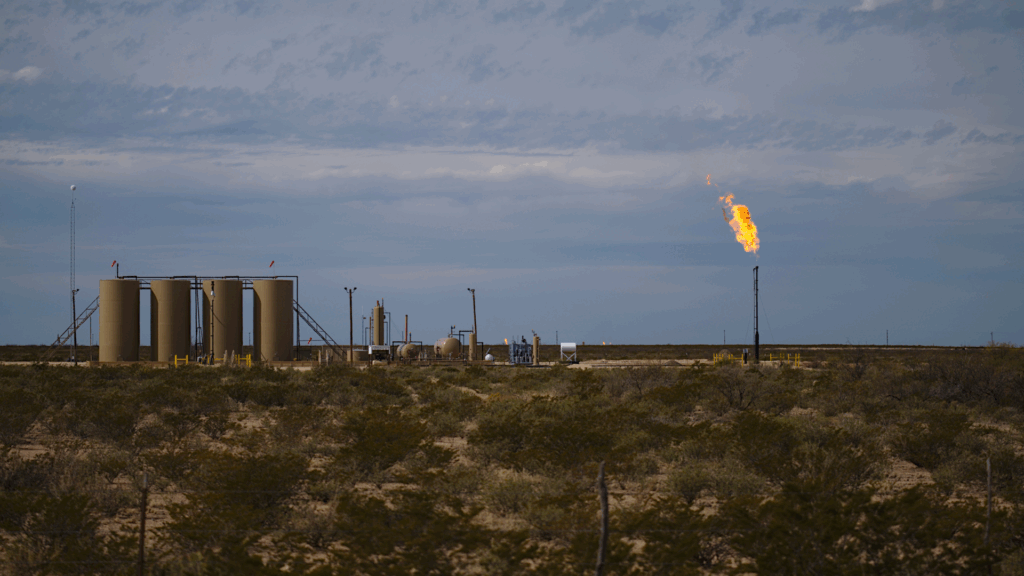

The Permian remains the most active basin in North America, but the nature of A&D activity is changing. Large-scale consolidations have slowed since early 2024, and 2025 has seen a rise in bolt-on acquisitions and core-focused divestitures. Buyers are no longer chasing acreage alone—they’re prioritizing assets with existing production, proven drilling inventory, and immediate development potential.

The Delaware sub-basin continues to draw attention due to its liquids-rich yields, but undeveloped positions without infrastructure or recent offset activity are seeing reduced interest. Sellers with clean data, contiguous blocks, and access to takeaway capacity are in the strongest position to transact. Meanwhile, operators shedding non-core assets are doing so to redeploy capital into tier-one inventory or improve balance sheet performance.

Disciplined Interest in the Williston Basin

The Williston Basin has entered a more stable, measured phase of activity. While still a top-tier oil-producing region, the Bakken play is attracting interest primarily for mature, PDP-heavy assets with potential for refracs or operational uplift. Buyers in 2025 are less speculative and more focused on long-term cash flow, making high-LOE or steep-decline wells harder to monetize unless the upside is well-supported by data.

We’re seeing the strongest demand in counties like McKenzie, Williams, and Dunn—particularly when assets are packaged with a mix of WI and royalty interests. Mid-sized companies with non-op positions are especially active, seeking to consolidate acreage or scale operations without increasing overhead. Successful sellers in this basin are offering clear PDP performance data, G&G support, and transparent title and regulatory documentation.

Renewed Momentum in the Powder River Basin

The Powder River Basin is emerging from a quiet period with renewed buyer interest, especially in oil-weighted zones. Formations like the Turner and Parkman are delivering stronger-than-expected results, leading to increased activity in Converse and Campbell Counties. While the basin still presents development challenges, 2025 is seeing more operators explore the region for both operated packages and producing assets with future upside.

That said, buyer selectivity remains high. Offers are strongest for assets with active production, development-ready locations, and minimal title or environmental risk. Data transparency is especially important in this basin, where variability in reservoir performance makes technical due diligence a key driver of deal execution.

Timing Matters: Market Windows Are Shifting

One of the biggest questions we hear from clients is: When is the right time to sell? The answer depends heavily on the basin, the asset type, and macroeconomic signals. In the Permian, for example, development-ready acreage may command a premium now, while in the Williston, buyers may wait for stronger PDP performance trends. In the Powder River, activity tends to follow infrastructure expansion and commodity price strength.

Sellers need to monitor not just WTI pricing, but also basin-specific rig counts, completion activity, and capital budgets. Timing a divestiture around these indicators can help ensure the asset reaches the right buyers at the right moment—especially in a market that’s moving toward quality over quantity.

Navigating Market Complexity

Executing a deal in today’s market involves far more than listing a set of wells or leases. Buyers are conducting deeper due diligence, asking more from data rooms, and placing a premium on assets that are clean, technically supported, and execution-ready.

This is particularly important for mid-market sellers who may not have full in-house M&A teams. Assets that lack clarity on title, environmental compliance, or regulatory status can quickly lose value or stall in negotiations. Even strong assets require thoughtful packaging and a targeted outreach strategy to reach the right counterparties.

Positioning for a Successful Transaction

The good news is that deals are still closing—and often at competitive valuations—when sellers are properly prepared and aligned with market expectations. That’s where Eagle River Advisors comes in.

We work closely with clients across the Permian, Williston, and Powder River Basins to prepare their assets, identify optimal timing, and target the right buyer pool. From technical evaluation and data room preparation to strategic marketing and negotiation support, our team helps upstream companies navigate every step of the A&D process.

In 2025, market knowledge and transaction experience are essential. If you’re considering a sale or acquisition this year, let’s talk about how to position your assets for success.