Sell Side Engagements

Status

Year

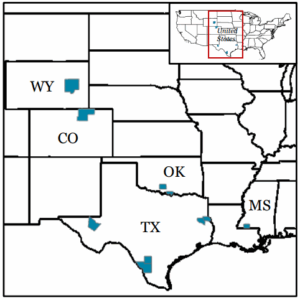

Multi Basin Mineral and Royalty Assets

Asset Summary

Area

Net Acres / % HBP/ Avg. Royalty

Permian

146 / 100% / 22.7%

DJ

568 / 100% / 12.5%

Powder

1,260 / 53% / 14.7%

Oklahoma

476 / 27% / 21.2%

Eagle Ford

Haynesville

Tuscaloosa Marine Shale

2,038 / 0% / NA

317 / 100% / 19.4%

76 / 0% / NA

Active

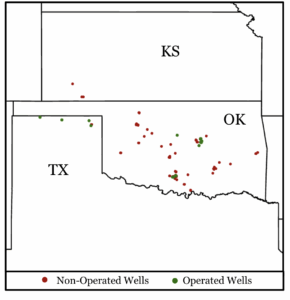

Mid-Con Operated and Non-Operated WI Assets

Asset Summary

Total Wells

103 PDP

PDP Wells

27 Operated / 76 Non-Op

Net Production (4/2025)

69 BOE/D (47% Oil)

PDP PV-9 ($MM)

$4.8 MM

PDP Reserves (2 Stream)

490 MBOE (76% Oil)

2024 Net Cash Flow

$900K 2

Active

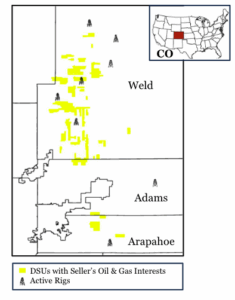

Mineral Asset Opportunity in the DJ Basin

Asset Summary

Gross Wells

774 HZ PDP / 29 WIP

Number of DSUs

267

Current Production (BOE/D)

~730 BOE/D (38% Oil)

LTM Cash Flow ($MM)

~$8.9 MM

PDP PV-10 ($MM)

~$25.5 MM

Active

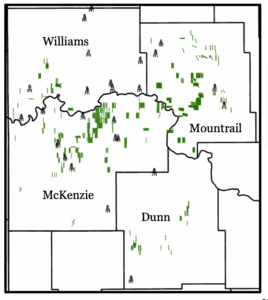

Non-Op Wellbore Only WI and ORRI Opportunity in the Williston Basin

Asset Summary

Gross Wells

940 PDP / 26 PDNP

Average WI % / NRI %

1.6% WI / 1.3% NRI (82.0% 8/8 NRI)

Wells with ORRI

77% of wells

TTM – 4/25 Net Operating Income

$3.7 MM

4/25 Net Production

531 boe/d

Active

White Rock Oil & Gas Williston Basin Leasehold Assets

Asset Summary

Total Net Acres

7,585 Net Acres

Total Net Bakken Acres

5,933 Net Acres

Middle Bakken PUDs

~76

2-Mile Middle Bakken Type Curve EUR

611 MBOE (79% Oil)

3-Mile Middle Bakken Type Curve EUR

904 MBOE (79% Oil)

Drilling Econ (2-Mile)

47% IRR /2.4x ROI

Closed

Joint Venture Drilling Opportunity in the North Park Basin of Colorado

Asset Summary

Total Investment Opportunity

~$22 MM

Total Wells

8 PUDs

Target Formation

Niobrara

Project Economics – IRR/ROI

46% / 2.7x