Authority for Expenditures

Monetize Your AFEs with Eagle River Energy Advisors

With a proven track record of success, Eagle River has facilitated wellbore AFE transactions representing approximately $3.5 billion in total drilling and completion (D&C) capital across 400+ wellbores in 10 major U.S. oil and gas basins, working alongside nearly 50 top-tier operators.

Why Use Eagle River to Sell Your AFEs?

▪ Track Record of Success

• ~$3.5B in gross D&C across 400+ wellbores

• 10 major oil & gas basins under ~50 operators

▪ Seller-Friendly Process

• No cost to the seller — buyers pay our fee

• $2.0B of buyer capital ready for non-op AFE investments

▪ Fast Execution

• Offers typically delivered within 7–10 days

▪ Technical Advantage

• In-house team analyzes AFE drilling economics

• Proprietary database drives stronger buyer offers

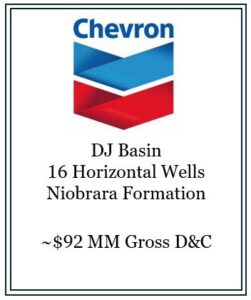

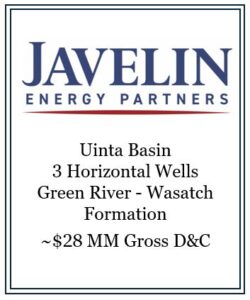

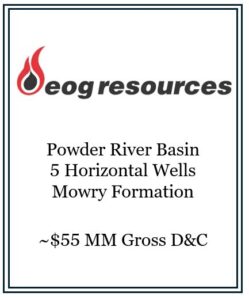

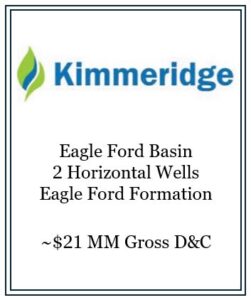

Notable AFE Transactions