An inside look at acquisition criteria from energy companies targeting $5M–$300M packages

If you’re a mineral rights, royalty, or working interest owner with assets valued between $5 million and $300 million, you operate in a competitive middle-market segment. This is a space where mid-sized oil and gas buyers—including private equity-backed operators and strategic energy companies—are actively acquiring, but only from sellers who meet very specific criteria.

In today’s market, securing the attention of these buyers requires more than just owning quality acreage. It means understanding what they value most, aligning your offering with their acquisition strategy, and presenting your package in a way that stands out.

1. Commodity Mix That Matches Buyer Demand

Mid-sized buyers are highly selective about the oil-to-gas ratio of the packages they pursue.

Current trend:

-

Gas-heavy packages located near LNG export terminals and pipeline infrastructure are commanding premium valuations due to rising global demand for U.S. natural gas.

-

Oil-weighted packages in core producing areas like the Permian Basin, Eagle Ford, and Williston Basin are still attractive—especially if they offer stable production and clear development upside.

Knowing how your commodity mix aligns with active buyer mandates is a critical first step before taking assets to market.

2. Clean, Organized, and Verifiable Data

One of the fastest ways to lose buyer interest is by presenting an incomplete or messy data set. Today’s serious buyers expect:

-

Clear mineral title and verified ownership

-

Complete production histories with accurate decline curves

-

Transparent lease terms, royalty rates, and operating agreements

Assets marketed with comprehensive oil and gas data packages not only close faster but also tend to attract more competitive offers.

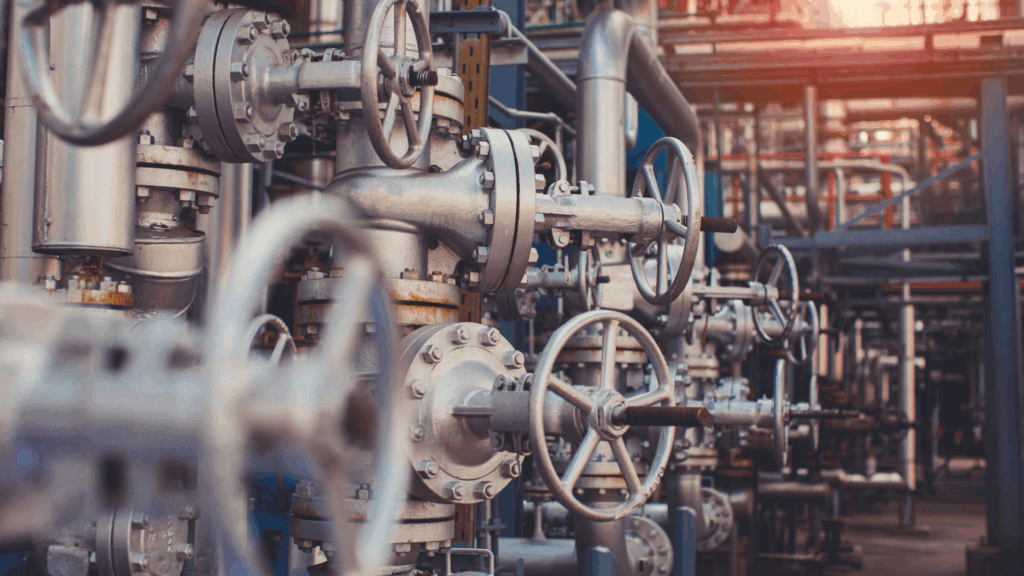

3. Infrastructure & Market Access

Infrastructure access is more than a convenience—it’s a valuation driver. Buyers place a premium on packages with:

-

Pipeline connectivity for oil and gas takeaway

-

Access to processing facilities or gathering systems

-

Minimal risk of midstream bottlenecks

In competitive bidding situations, proximity to infrastructure can be the deciding factor between two otherwise similar assets.

4. Development Potential & Operator Track Record

Mid-sized buyers look beyond current production. They evaluate:

-

PUD (Proved Undeveloped) drilling locations

-

Likely development timelines

-

The historical performance of the current operator

Assets with both predictable cash flow and a compelling development story often see stronger offers and faster closings.

5. Realistic Seller Expectations

In the oil and gas acquisitions space, mismatched expectations can kill deals. Serious buyers know the market inside and out. They expect pricing that reflects:

-

Basin-specific economics

-

Commodity price trends

-

Decline curve projections

Sellers who enter negotiations with realistic valuation ranges—based on current market data—are far more likely to secure a successful transaction.

How Sellers Can Compete in Today’s Market

With limited access to qualified mid-sized buyers, sellers in the $5M–$300M range need to:

-

Identify their most likely buyer pool based on commodity mix and location.

-

Prepare a professional data package that reduces due diligence friction.

-

Align pricing expectations with current market trends.

The Eagle River Advisors Advantage

At Eagle River Advisors, we specialize in helping mineral rights and royalty owners successfully navigate the middle market. Our team:

-

Targets the most relevant mid-sized buyers for your assets

-

Packages data to meet buyer expectations

-

Negotiates based on up-to-the-minute market intelligence

If you’re looking to position your holdings for maximum buyer interest—and secure top-dollar in today’s competitive oil and gas acquisitions market—our experience can give you the edge you need.

Bottom Line: Mid-sized buyers in the $5M–$300M segment know exactly what they want. Sellers who understand these acquisition criteria, prepare their assets accordingly, and work with the right advisory partner have a much higher chance of closing strong deals quickly.

📞 Ready to get your assets in front of serious buyers? Contact Eagle River Advisors today for a confidential asset review.